Accepting and acquiring cards is still a juicy and safe business, but is this enough for Industry and its customers?

This post of Martin Harbech on Kodak resonated with the here above intro statement. Quick summary of Martin (for those lazy to click the link) :

Kodak did not disappear because they did not invest into digitisation of photography. No. It was because their core business (photo film) was too profitable for them

Now if we have a closer look at the market cap of Stripe, Adyen, even older actors as well as EBITDA revenue in 2022, card margin are still enough interesting.

Things are doing extremely well, beside Stripe negative EBITDA revenue, positive in 2023. But they have got a bigger market cap than Worldpay, Checkout.com and Global Payments all together.

Checkout.com is a bit aside, more modest in size but confirming a dynamic on revenue growth, even after the crypto winter following COVID 19.

All those Paytech actors are sometimes reaching valuation close, equal or more than some European Banks : BNPP, CommerzBank, Deutsche Bank, Unicredit etc… But Banks provides a wider variety of financial services.

Ok, we are good on figures so now, let’s talk about alternatives to card…

Which world class card acquirers today has got a non card solution as solid as its counterparts for cards? None of them.

But what does make Card business such a profitable business that you even decide to walk away from alternatives ?

- Card is still the most used payment method in the world (outside China)

- Only two actors (Visa and Mastercard) dominates and frames strictly the rules allowing to operate with a long term stability a business

- Four corner model relies on a simple equation: merchants pay all the actors of the value chains to accept card and assume the cost burden.

Is this a sustainable solution for each transaction we make? I am not sure. Even if accepting and acquiring cards is still a juicy and safe business, merchants also have got new demands.

Merchants’ expectation on Industry is shifting

Merchants demand more transparency, more choice vs the cost invoiced.

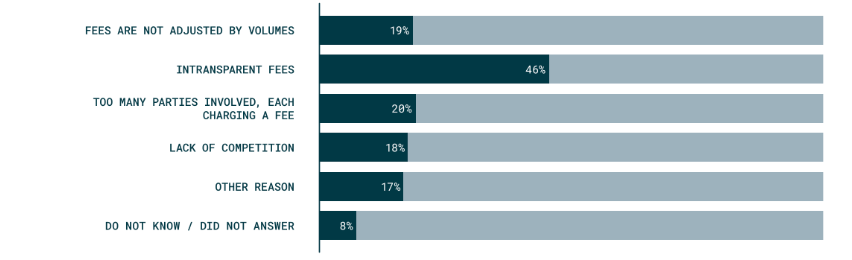

We don’t even talk about the efficiency of the whole process. At the question “Which reasons card acceptance fees are not deemed to be fair”, here is the answers of European merchants on this report from Artwright Consulting.

Non-card based methods (so excluding ApplePay) are also quickly progressing in Global South. According to freshly printed out Worldpay 2024 Global Payment Report (link here), non card payment are now dominant in India, China and challenging Card payments in Brazil, and ASEAN region.

Card helped a lot. VISA and Mastercard have had a significative impact on how e-com and POS payment is shaped today.

But the big mammoths of payment should be careful, as the risk of fragmentation is more than ever present, and their offers have never been so unified around international cards.

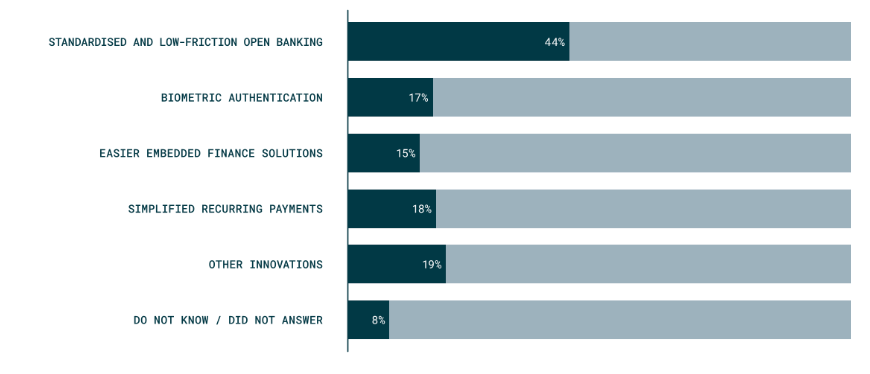

Mastercard and Visa leadership is now seriously challenged, and not only on Global South. At the question “What innovations would you like to see in Payment services” asked by Artwright Consulting on the same reporting as above, here is the answer of European merchants in this reporting.

Here the last word of this Linked’in article that sounds ominous

For innovation to succeed, you often have to be willing to compete with your core business.