HEYTEA global expansion, supported by checkout.com made headlines last week. Now Adyen rushed to publish their press releases—just five days apart. Both companies framed themselves as key players in HEYTEA’s move beyond China. But here’s the real tea, dear sippers: what is being positioned as a global payment revolution by Checkout and Adyen marketing is a calculated, small-scale rollout. No more. Therefore, HeyTea global expansion is a push for a POS-less retail payment or just a simple test and try?

The great wor(l)d of Press releases.

The PR Narrative said HEYTEA was embracing « unified commerce », and « scaling internationally with cutting-edge payment tech », but in reality, HEYTEA has 3,400+ stores in China and operates their platform to sell their product.

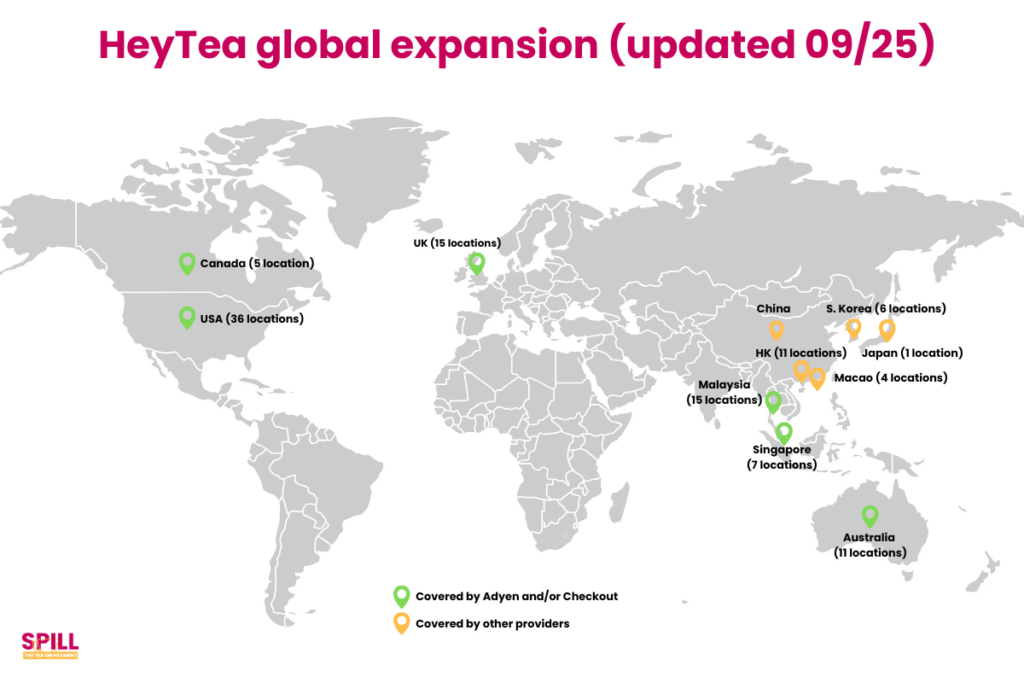

However, locations overseas are not numerous. HeyTea expanded into hotspots for Chinese communities. In 8 countries, Adyen has announced in PR four countries and Checkout six countries. The impact is limited, and so is the expansion of HeyTea.

The real story isn’t about payment innovation; it’s about cost efficiency, multi-acquiring strategies, and navigating the outdated world of Western payments to test and try for a new form of commerce.

Read my 16-page case study on HeyTea for free, click here

The Real Tea is a story of a constrained global expansion. Current providers cannot follow the merchant in this great global expansion to push for POS-less retail payment. HeyTea created an innovative customer experience. In the HeyTea WeChat Page, you can sip a signature drink in-store, get it delivered, and buy tea bags or packs of tea bottles.

But this innovative and hybrid approach approach ended up collaborating with global PSPs who reframed it as a « unified commerce » revolution.

HEYTEA expansion: a big dilemma for providers’ selection

Inside China, HEYTEA never had to worry about payments.

Transactions were seamless, costs were low, and checkout was nearly invisible. Alipay and WeChat Pay handled everything with maestria and technology. Alipay and WeChat, with their multiple integration cases, can handle all types of transactions. But the moment HEYTEA stepped outside China, this is where the real battle started.

Many assume that Alipay and WeChat Pay are global payment giants. But while they do cater to tourism hotspots for Chinese travellers, their role inside China is way very different from how they function abroad.

Here’s their key problem:

- Alipay and WeChat are digital wallets for Chinese, not acquirers which is an issue in a card-centric world where merchants expect to have non-Chinese customers.

- Therefore, their capacity to process Visa or Mastercard transactions are limited.

- They mainly rely on third-party PSPs to enable payments outside of China. (Ironically Adyen)

It meant HEYTEA couldn’t rely on them for acquiring transactions in non-Chinese markets. To process card payments abroad, they needed to find a global acquiring partner.

An Irony for a POS-less company…

In China, HEYTEA was already operating in a POS-less world, fully integrated with its own payments ecosystem. In China, retailer outlets barely operate with a traditional POS system, and terminals are nearly extinct, especially in Tier I cities like Beijing, Shanghai, Shenzhen or Guangzhou.

But when Heytea stepped outside China, they discovered they had to rely on Western PSPs that are still pushing “unified commerce” as a service with a full cohort of POS machines and integrations.

What’s being sold as innovation in the West is already over in China. Unified commerce is POS-less.

Western reality: card-centric and POS obsessed

In China, cash is dead, cards are scarce, and wallets dominate. But in the West, credit & debit cards are still king—even when used inside digital wallets.

In China: Consumers use WeChat Pay & Alipay for everything, while in the US & Europe: Even when using Apple Pay or Google Pay, the underlying transaction still runs on Visa or Mastercard rails.

For HEYTEA, it represents a problem.

They couldn’t escape the duopoly outside China, and a cohort of new problems, including the cost aspect. Visa and Mastercard are expensive solutions, especially in the market they operate in: Australia, Hong Kong, Canada, Malaysia, Singapore, South Korea, the UK and the US.

Those markets are known for being pretty expensive. Suddenly, Interchange fees mattered, and a cost centre that used to be nonexistent, namely, Payment processing, appeared.

Adyen & Checkout.com appeal to tell a story on innovation

HEYTEA could have picked any global PSP. Adyen & Checkout.com aren’t uniquely positioned for this. But in a payments market where differentiation is difficult, both providers needed a high-profile case study. Look at how they positioned it in the press release:

🔹 Adyen: “We are enabling HEYTEA’s expansion through our unified commerce platform.”

🔹 Checkout.com: “We are helping HEYTEA offer an enhanced digital payments experience.”

Here is the harsh reality:

📌 HEYTEA doesn’t even use POS in China (update: Adyen explained HeyTea uses a POS terminal in some locations). The unified commerce aspect remains to be determined, as Checkout.com and Adyen both operate online transactions. So, how do we define “unified commerce”? What are we talking about?

📌 HEYTEA isn’t using one provider—it’s benchmarking multiple acquirers, commoditising them.

📌 The expansion is relatively small (updated in September 2025, less than 100 locations overseas)—this isn’t Starbucks rolling out in 500+ locations.

Yet, Adyen & Checkout.com framed it as a game-changer. The reason behind it? In the payment space, perception matters. If they can make a +40-location rollout look like a global retail shift, they boost their reputation.

How Adyen & Checkout changed HEYTEA’s test rollout into a “Global Expansion” success story

HeyTea global expansion is not the payment revolution that Adyen & Checkout.com want you (and themselves?) to believe. Both PSPs rushed to drop their press releases within five days of each other, competing to frame HeyTea tiny rollout as a major global milestone.

The PRs say that HeyTea is embracing a « cutting-edge, unified commerce model. » and « expanding rapidly with new payment technology. » (Note Sep 2025: Both Companies edited those quote since then)

The reality is far simpler: HeyTea’s expansion of POS-less payment is a small test, benchmarking acquirers, and avoiding massive POS investment.

The funniest point in this story? Adyen launched a nuclear weapon for actually a pretty small number of transactions and locations, far from their original product proposition, enabling large-scale unified commerce for Entreprise customers by selling heavy investment in hardware and software. Adyen must be way more attracted to the 3400 outlets in China.

Checkout is a bit more aligned with their current strategy, namely, not going to face-to-face transactions.

Unified commerce or POS-Less Retail Payments?

HeyTea didn’t choose Adyen or Checkout.com because of their unified commerce technology or whatever. They chose the best compromise between test and try, technically easy to integrate and cost optimisation. Both PSPs’ PR spin about “unified commerce” and “cutting-edge tech” is more a marketing gimmick than a reality. Heytea global expansion a push for a POS-less retail payment or just a simple test and try? Will this bet work in such a card-centric world?

It also asks a good question, the big beasts of Chinese retail show the teeth but are handicapped to go overseas, because of over-ageing business practices, we have in the West.