Retail Payments, once a global promise, are now a fragmented reality. The baseline of Visa and Mastercard, which is their sales promises is not as promising as it used to be:

A borderless network for you to pay wherever you want.

A unified and globalised network for your cardholder to spend more and more.

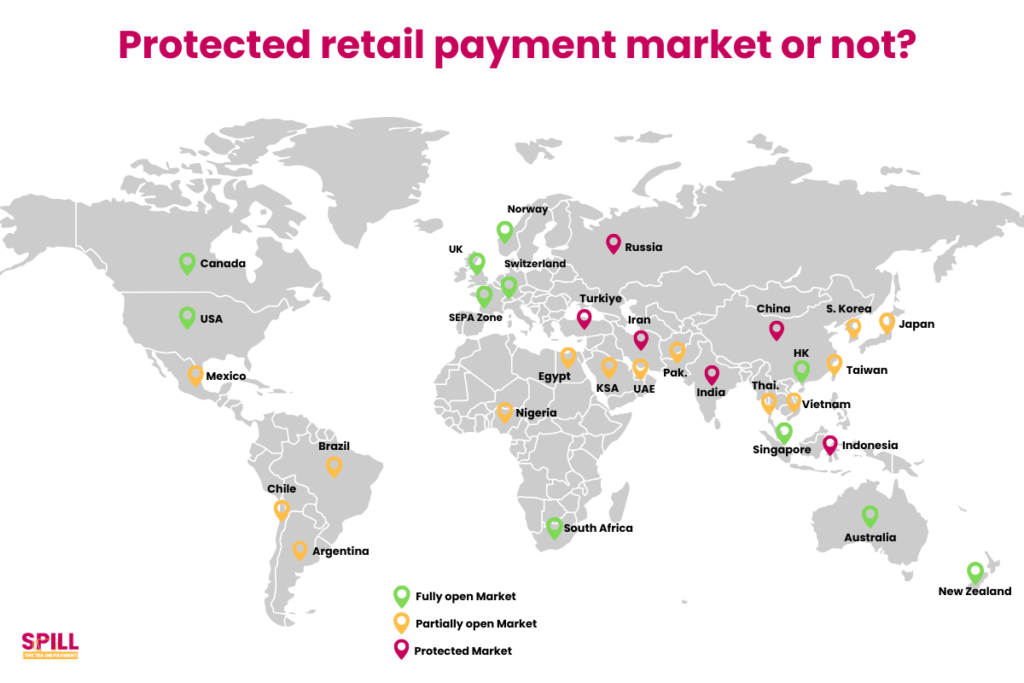

However, recent geopolitical events—such as the COVID-19 pandemic and the Russia-Ukraine war—have exposed the limitations of this vision. The reality is that retail payments are not as globalised as once assumed. Hard borders still exist, and access to payment networks can be restricted based on political and economic interests.

The crucial role of Visa and Mastercard in digital payment network

Card payment and the duopoly have played a tremendous role in shaping the standardisation of digital payments.

Their networks enable transactions in over 200 territories, supported by more than 15,000 financial institutions. In many regions, their brand has become synonymous with payment acceptance itself.

This dominance has led to an assumption that having a Visa or Mastercard product automatically means having access to a market

Global Paytech actors like Worldpay, Adyen, and big banking machines also sell this idea. Everybody has got a Visa card, right?

However, this assumption often overlooks the complexities of local payment ecosystems

Emerging economies refuse to tie the knot with American companies

The leadership of duopoly is more and more disputed, even in countries traditionally favorable for them.

Regulators worldwide have introduced measures to curb their influence, such as:

- The Durbin Amendment in Dodd-Frank Act (U.S.) – Introduced in 2010, it placed caps on interchange fees for debit cards, limiting Visa and Mastercard’s pricing power.

- Least Cost Routing (Australia) – Encourages merchants to process transactions through lower-cost networks instead of Visa or Mastercard.

- Interchange Fee Regulation (EU) – Imposes limits on credit and debit card interchange fees, reducing revenue for the duopoly.

But some countries facing the emergence of digital payment have taken more radical approaches. They want to contain Visa and Mastercard leadership on digital payments. Retail Payments are now a fragmented reality

They are aware that Visa and Mastercard are American companies. Visa and Mastercard, as American entities, must comply with U.S. sanctions and foreign policy decisions. For example:

- Iran: Visa and Mastercard transactions have been virtually non-existent due to U.S. sanctions.

- Russia: Following the 2022 Ukraine invasion, Russian banks were cut off from Visa and Mastercard, impacting more than 75 million cardholders.

The retaliation capability of American government with the dollar is also strong, so using American networks ties your economy with the American economy and prevents a certain strategic autonomy.

This is the reason why China and India have developed their domestic network: to protect their interest.

The Search for Alternatives

Emerging markets are not just resisting Visa and Mastercard for political reasons; they are also seeking cost-effective and locally adapted solutions. The high fees associated with Visa and Mastercard make them a luxury product in many developing regions. On average:

- Visa and Mastercard merchant fees range from 1.5% to 3.5% per transaction.

- Local networks often charge less than 1%, making them significantly more viable for merchants.

A major barrier to digital payment adoption in these markets is the lack of affordable acceptance infrastructure. Globally, cash remains dominant, with many small businesses unable to afford digital payment processing fees. According to the United Nations, SMEs represent about 90% of all private businesses and account for over 70% of employment and 50% of GDP. Despite their economic significance, these businesses often struggle with limited access to cost-effective digital payment solutions, reinforcing reliance on cash.

Local payment networks offer significantly lower fees and better integration with domestic financial systems, making them a more viable option for merchants and consumers alike. By developing their systems, emerging economies can promote financial inclusion while reducing the cost of electronic payments.

Understanding market dynamics should be the basic

Retail Payment is now a fragmented reality, and for any foreign company looking to expand internationally, understanding the local payment landscape is crucial. Businesses that assume Visa and Mastercard are sufficient for market entry may encounter unexpected challenges. Instead of relying on existing providers without due diligence, companies must assess whether local networks offer a more effective and cost-efficient solution.

Visa and Mastercard remain dominant players in global payments, but their grip on digital transactions is no longer unchallenged. As emerging markets build their ecosystems, the notion of a unified, globalised retail payment market is becoming increasingly outdated. Companies that recognize this shift and adapt accordingly will be better positioned for long-term success in the evolving payments landscape.